10 Best Ways to Track Your Monthly Expenses

As a monthly salaried person or institution, tracking monthly expenses is a crucial aspect of personal finance management. In this article we are going to explain about “How to Track Monthly Expenses,” Here we are going to explain in detail about how to prevent unnecessary expenses and to know expense trackers. Along with that we will guide you through the best practices and tools for effectively monitoring and categorizing your spending.

![]()

If you are a person who always dreamt to create a budget, save for a specific goal, or simply gain a better understanding of your financial habits, this comprehensive guide will drive you to some of the spectacular knowledge and resources to take control of your finances. Below there are major 10 ways to prevent your unnecessary expenses and best expense trackers.

10 Best ways to track your monthly expenses

Let’s discuss one by one regarding expenses trackers and people who know their financial statements, especially expenses.

1. Spreadsheet Software

During your monthly expenses tracking we came across the initial plan called Spreadsheet software. It is a software which is used for budgeting and can provide an at a glance snapshot of your financial pictures. This can be made through programs like Microsoft Excel or Google Sheets to create a detailed spreadsheet to track your expenses. However you can also make online templates or computer programs to make our budget spreadsheet more efficiently. It requires you to know basic math’s and financial statements.

2. Check your Account Statements

Checking your account statement frequently will also be one of the easiest ways to cut off all your monthly expenses. In order to check bank statements and all credit cards you have to give a clear picture to identify your spending patterns. Your spending will consist of both fixed and variable expenses. Fixed expenses are less likely to change from month to month like rent, electricity bills, insurances and debt payments. While variable expenses vary from season to season and time to time like food, clothing and travel things.

3. Budgeting Apps

![]()

App plays a very crucial role in the present digital lives even for controlling expenses. You can simply install an app in your android or iPhone store to trace all monthly expenses. It will reduce the cost of travel to the bank or create any sheets. More convenient way to rectify our financial mistakes is to install budgeting apps like Mint, YNAB, and Every Dollar, which can help you track and categories your expenses. These are secure, comprehensive, accurate and efficient money management systems.

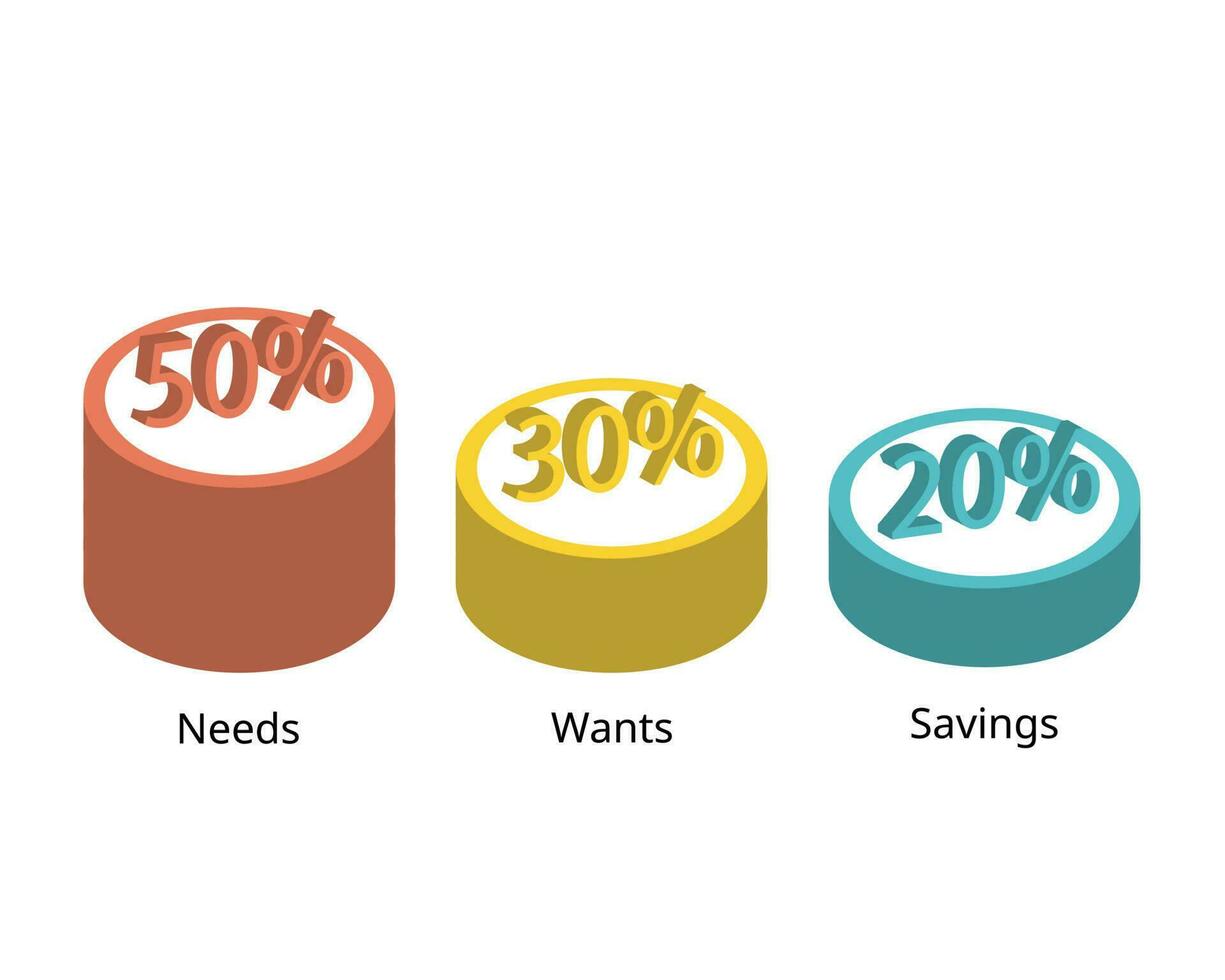

4. Categories the Expenses

Start to group your expenses into different categories. Sounds like a traditional method but an effective one. Finance websites and credit cards tag your purchases in categories like “departmental stores or automatic to identify. Then you understand which one so impulse buys at target are costing a lot. Otherwise you can also do in order to break them into needs, wants and savings. It is also popularized as a 50/30/20 budget plan in which you can physically write down your expenses in a notebook or journal.

What are the Financial Responsibilities?

5. 50/30/20 Budgeting Method

In simple 50/30/20 budgeting method means dividing your income into 50/30/20 categories. 50% of incomes goes to needs like payment of debt, insurance or rent, while 30% of monthly incomes goes to wants like shopping, travels or entertainments and the rest 20% belongs to savings and debt pay downs beyond the minimum. These needs and wants can help you to organize your budget and prioritize your spending. So systematic budgeting method to reduce the over loopholes of expenses. It will be helpful to set aside a fixed amount from your income for each of the categories.

6. Envelope System

Envelope system is a cash used cash based approach. Here the envelope explains how to stick to your budget and be more deliberate with their spending’s. Here divide your cash into envelopes for different spending categories, and keep track of your expenses by noting down each expenditure. You can start with different envelopes and each of them represents budget categories. Later you can sort a certain amount of money to each according to spending in a particular month. Remember once the envelope is empty you can’t spend any more money in that category until the new budget period starts.

7. Expenses Tracking

If you don’t want an online method or 50/30/20 methods you can choose one of the easiest methods when it comes to checking expenses is expenses tracking. You can choose a variety of free budgeting templates online and online budget worksheets. You can also do vice vice versa like save and organize your receipts to have a tangible record of your expenses at the end of the month. Quicken, it is a software with extensive budget and tracking features. It will make your import bank transaction and investment monitoring very easy, especially during more financial complexes.

8. Online Banking Tools

Most advanced and convenient way of tracking the expenses is online banking. As we know, making banking or financial transactions via the internet is called online banking or web banking or internet banking. It replaced many traditional modes of transactional activities like deposit, transfer and payments. Due to these advancements banks offer online tools and features that allow you to categories and track you’re spending directly from your account. Eg; Yono SBI, bank point, cardswap and mobile banking.

9. Personal finance software

You can also see your expenses through some of the world’s top finance software’s like Mint, YNAB, Turbo tax, Quicken and every dollar. These software’s masters explain about track spending, create budgets and future expenses plans. Use specialized software to track and manage your expenses in detail. Remember some software’s are differ by features, import methods, software codes, mobile app features, import methods, monetization method and development transparency.

10. Try to lower your expenses

Always start reducing your expenses from yourself and find where you can rectify it. Always lower the big fixed expenses in your life like the cost of housing, vehicles and utilities and shopping and entertainment. These things will significantly impact your budgets. Remember which is inevitable in life and which is not and make payments based on that. Keep in mind that how much you earned it doesn’t matter, how much you saved is the biggest matter to get rich.

Related Articles: Pet Insurance.