Pet Insurance- How to find a perfect Pet Insurance?

Pet insurance is also a type of insurance coverage that helps pet owners pay for their pet’s medical and health related expenses. It typically covers unexpected accidents, illnesses, and injuries of your pets. Like human health insurance, pet insurance policies vary in coverage, quotes, cost, service and conditions. Some plans may also cover routine care such as vaccinations and annual check-ups. The main goal of Pet insurance is to provide peace of mind and financial protection in case you’re pet needs veterinary care.

How to find a perfect Pet Insurance as per your needs and requirements;

Before going to purchase a valid insurance for pets, you have to come across some of the factors. Those are;

1. Look for Reviews

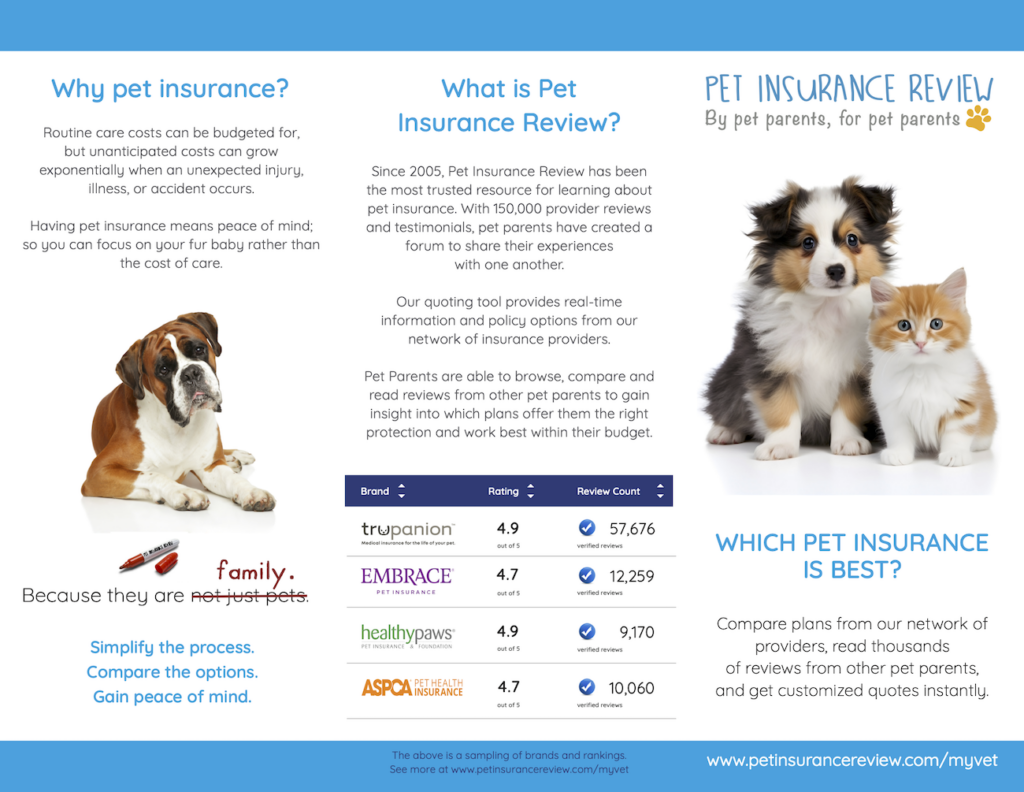

It is the most common activity done by the most optimistic insurance seekers for their pets. Reviews is data which shows us where people have already used and gives their used opinion about particular insurances. Once you understand the reviews and comments about particular insurance companies or seekers, then you can come to the conclusion whether he or she should buy it or not. Websites like Consumer Reports, Pet Insurance Review, and Trustpilot can provide insights into various pet insurance companies based on customer reviews and ratings.

2. Compare Coverage

Compare insurance coverage is a crucial task to know which pet insurance coverage suits your convenience. Study what coverage options are fit for your pet, such as accident coverage, illness coverage, wellness plans, and more. Make sure the insurance provider offers the coverage you need. Coverage like dental illness coverage, accidents, chronic conditions, common illness, diagnostic testing, behavioral problem and medication and supplements are basic coverage must include in your pet insurance plan.

3. Check Customer Service

No business or company will not survive in the market until or unless you are not going to provide a quality of customer services. As like in Insurance companies it is very important to penetrate customers through good customer relationships. Customer service shows how each company handles customer queries, claims, and issues. A good customer service experience can make a big difference when dealing with pet insurance. It clarifies your insurance related queries like pricing, coverage, quotes and medication and illness or testing’s.

4. Get and compare Quotes

Getting insurance quotes is free either through online or phone/email/in person. Online quotes are easy to get in order to answer a few questions about the animals. Phone/email/in person is another way you get pet insurance quotes. If you are already an insurance holder or speak to someone about your options, many insurance companies will connect you to an agent by phone/email/in person. However, after obtaining quotes from multiple pet insurance companies, you have to compare pricing, deductibles, and reimbursement rates. This will help you find a plan that fits your budget.

5. Check for Exclusions

There are different sorts of exclusions available under the Pet Insurances. Exclusions means areas your pet insurance doesn’t cover, and they can be varying depending on your specific provider and policies. It is also one type of review tool, to understand exactly what you are getting and not getting. It is very important to know what is excluded from the coverage before going to purchase it. Some policies may not cover pre-existing conditions, certain breeds, or specific treatments. Most common exclusions in pet insurance like age restrictions, bilateral conditions, breed restrictions, behavioral conditions, pregnancy, administration costs and preventable diseases.

6. Consider Reputation and Financial Stability

Only financially healthy and stable companies will be able to pay good return to their investors and dividend to shareholders. Likewise in insurance companies well maintained or goodwill companies are going to pay out claims promptly. It is very important to study properly which pet insurer is providing healthy and proper claims to their holders along with its financial and goodwill status from the last 5 to 10 years. Apart from that, convenient access of the process of paperwork’s, reimbursement process and customer service is also crucial in a company.

7. Consult Your Vet

Your veterinarian may have knowledge about pet insurance providers based on their previous experiences with other pet owners. Many pet insurance service providers do not include disease like hepatitis, leptospirosis and distemper until consulted or vaccinated by the registered Veterinarian. Veterinarians are also able to answer your basic queries regarding insurance coverage, company and quotes of your Pet or Breed.

8. Read the Fine Print

Most of the people neglect or least bother about details in fine print. If you are unsure then make sure to talk with your personal insurer and get clear clarity and free of doughnuts about it. Purpose of reading the fine print to better understand your policy, offers legal protections, and to save money and time too. Make sure to read and understand the policy details, including limitations, waiting periods, and any hidden fees before going to purchase it.

9. Ask About Discounts

Discount you may seek your daily products like groceries or textile items. Likewise you can ask discounts in a great way to get discounted pet insurances that owners should familiar themselves with as they embark on the insurance hut. Inquire about any available discounts for insuring multiple pets, paying annually, or being a member of certain organizations. You have to understand whether your insurance is eligible to get discounts like upfront discounts, multiple pet discounts and bundling discounts.

10. Consider Telemedicine Options

Suppose if your pet is sick or injured, telemedicine can connect you with a licensed veterinarian for a consultation. Moreover, Telemedicine is a crucial tool to keep your pet healthy and happy without more crises. Some pet insurance companies offer telemedicine services which can be convenient for minor health concerns. Interestingly Telemedicine can help you to save money through a cat wellness plan covering routine care and preventive care at a discounted rate.

Above 10 factors are very important to those who wish to purchase pet insurance. It will be easy to justify and give a final judgement to which insurance is suitable according to your budget and preferences.